CORPORATE GOVERNANCE AND COMPLIANCE

İş Leasing executes its rights and responsibilities with its stakeholders through an approach of accountability, equality, transparency and responsibility.

İş Leasing executes its rights and responsibilities notably with its shareholders as well as its employees, customers and all other stakeholders within an effective management and audit framework encompassing an approach of accountability, equality, transparency and responsibility, which are the universal elements of its corporate governance approach.

By integrating all necessary policies and measures into its practices, the Company operates in compliance with all of the mandatory articles in the Corporate Governance Principles, and declares its responsibilities and compliance level within the framework of the CMB’s Corporate Governance Communiqué through the Corporate Governance Compliance Report. As per the CMB’s resolution no. 2/49 of January 10, 2019, the Corporate Governance Compliance Reporting no. II-17 has been drawn up over the Public Disclosure Platform (KAP) by using the templates “Corporate Compliance Report (URF)” and “Corporate Governance Information Form (KYBF)”. Related reports are available at https://www.kap.org.tr/en/sirket-bilgileri/ozet/988-is-finansal-kiralama-a-s.

At İş Leasing, the Internal Audit Department and the Internal Control, Risk Management, Compliance and Legislation Department offer reasonable assurance in terms of the efficiency and effectiveness of operations affected by the Board of Directors, Senior management and other employees of the Company, the reliability of reporting, and the achievement of compliance with laws and regulations. Audits conducted by the Internal Audit Department and the Internal Control, Risk Management, Compliance and Legislation Department consider the compliance of the processes defined within the scope of sustainability management with internal policies, principles and targets by also taking into account the internal audit standards. Under audit activities, periodic and risk-based reviews are carried out by also encompassing anti-bribery and corruption. Activities related to compliance with regulations are followed up by the Internal Control, Risk Management, Compliance and Legislation Department. The department manager also acts as the statutory “Compliance Officer” and fulfills his/her duties and responsibilities stipulated in the Law on Preventing the Laundering of Proceeds of Crime and the relevant legislation under the Corporate Policy and Compliance Program. It is essential that the risks to which the Company is exposed are within the limits stipulated by the legislation and in compliance with the Company’s basic strategies, and risk processes are executed in accordance with the internal regulations approved by the Board of Directors and the legislation to which the Company is subject. The risks that may be encountered during the activities are identified and classified through the “Corporate Risk Catalogue”.

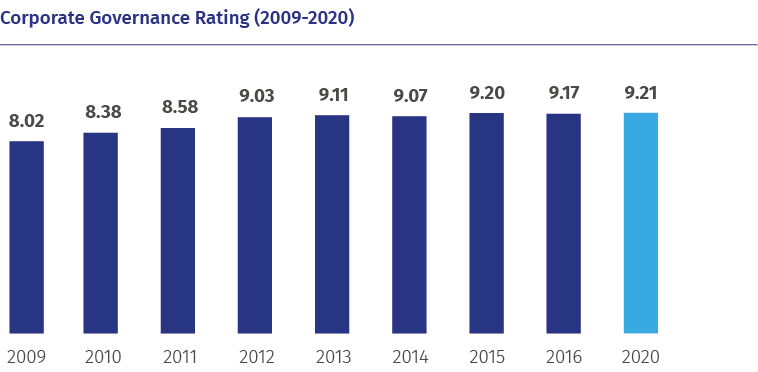

İş Leasing was included in the BIST Corporate Governance Index in parallel with its effective corporate governance practices. As a result of the rating study carried out by Saha Kurumsal Yönetim ve Kredi Derecelendirme A.Ş. in 2020, the corporate governance rating of the company was identified as 9.21 (92.13%) out of 10 by considering the importance attached by the Company to the corporate governance principles, its willingness to execute this as a continuous and dynamic process and the improvements achieved since the allocation of the previous rating.

Corporate Governance Rating (2020) 9.21

At İş Leasing, shareholder rights are exercised as per the legislation, articles of association and other internal regulations, and measures have been taken to ensure that these rights are exercised. The Company’s relations with shareholders are handled by the Investor Relations Department. The Company has a publicly-disclosed dividend policy and there is no restriction on the transfer of shares. Practices that make it difficult to exercise the right to vote are avoided and every shareholder, including cross-border shareholders, is provided with the opportunity to exercise their right to vote in the easiest and most appropriate way.

The Board of Directors, which consists of 9 members including 3 independent members, is authorized and responsible for monitoring, overseeing and developing the public disclosure and information policy within the Company. Corporate Governance, Audit and Early Detection of Risk Committees serve within the Board of Directors. The Corporate Governance Committee, which consists of three members of the Board of Directors and the Investor Relations Department Manager, monitors the compliance of the Company with the Corporate Governance Principles, offers suggestions to the Board of Directors in this regard, and the Investor Relations Department coordinates the disclosure function.

The Investor Relations Department was established within İş Leasing in order to execute the relations with shareholders in an orderly way and to solve the investor problems in the most efficient way, and the activities of the department are regularly reported to the Board of Directors and the Corporate Governance Committee.

The activities regarding internal control and internal audit are supervised, assessed and guided by the Audit Committee for the monitoring of material issues. Operating under the Board of Directors through the Audit Committee, the Internal Audit Department and the Internal Control, Risk Management, Compliance and Legislation Department contribute to the establishment, development and improvement of risk culture throughout the Company. The Audit Committee periodically evaluates the effectiveness of the internal control system and the results of the internal control activities through the reports drawn up by the Internal Audit Department and the Internal Control, Risk Management, Compliance and Legislation Department, and makes recommendations to the Board of Directors regarding the measures to be taken in response to the findings in the said reports.

Within the framework of the audit plan prepared at the end of each year, all departments are audited every two years, all branches are audited every three years, and additional legislative compliance audits are carried out. A quarterly report is submitted to the Audit Committee, which consists of three independent members. A total of 17 internal audit activities were carried out in 2020 and the audit reports were submitted to the Audit Committee and the Board of Directors for information.

The committees convened 4 times in 2020, and a total of 8 reports were presented to the Board of Directors, 4 by the Compliance Officer and 4 by the Financial Management Department.

During the period, there was no practice for which the company was held liable by public administrations.

GRI 102-11, 102-15, 102-16, 102-17, 102-18