In order to leave a more habitable world to future generations and accelerate the transition to a low-carbon economy, İş Leasing considers sustainability an integral part of its business methodology; acts with the awareness of creating sustainable value for its customers, shareholders, employees and all other stakeholders and integrates this approach into all its processes. In line with its corporate culture and identity, the Company treats sustainability in a holistic way with economic, environmental and social dimensions, and considers it in its activities together with all the relevant laws and regulations.

In line with sustainability awareness, İş Leasing accelerates its Green Transformation Vision through its sustainable finance practices, primarily on climate change. It is targeting measures for effective use of resources and energy in order to ensure the transition to a low-carbon economy, especially by offering services for energy efficiency and renewable energy investments. İş Leasing is steadily committed to its sustainability activities, which it initiated in order to contribute to a sustainable and habitable future.

İş Leasing demonstrates an integrated perspective with positive value principles for economic, social and environmental solutions in all of its practices to achieve long-term growth targets.

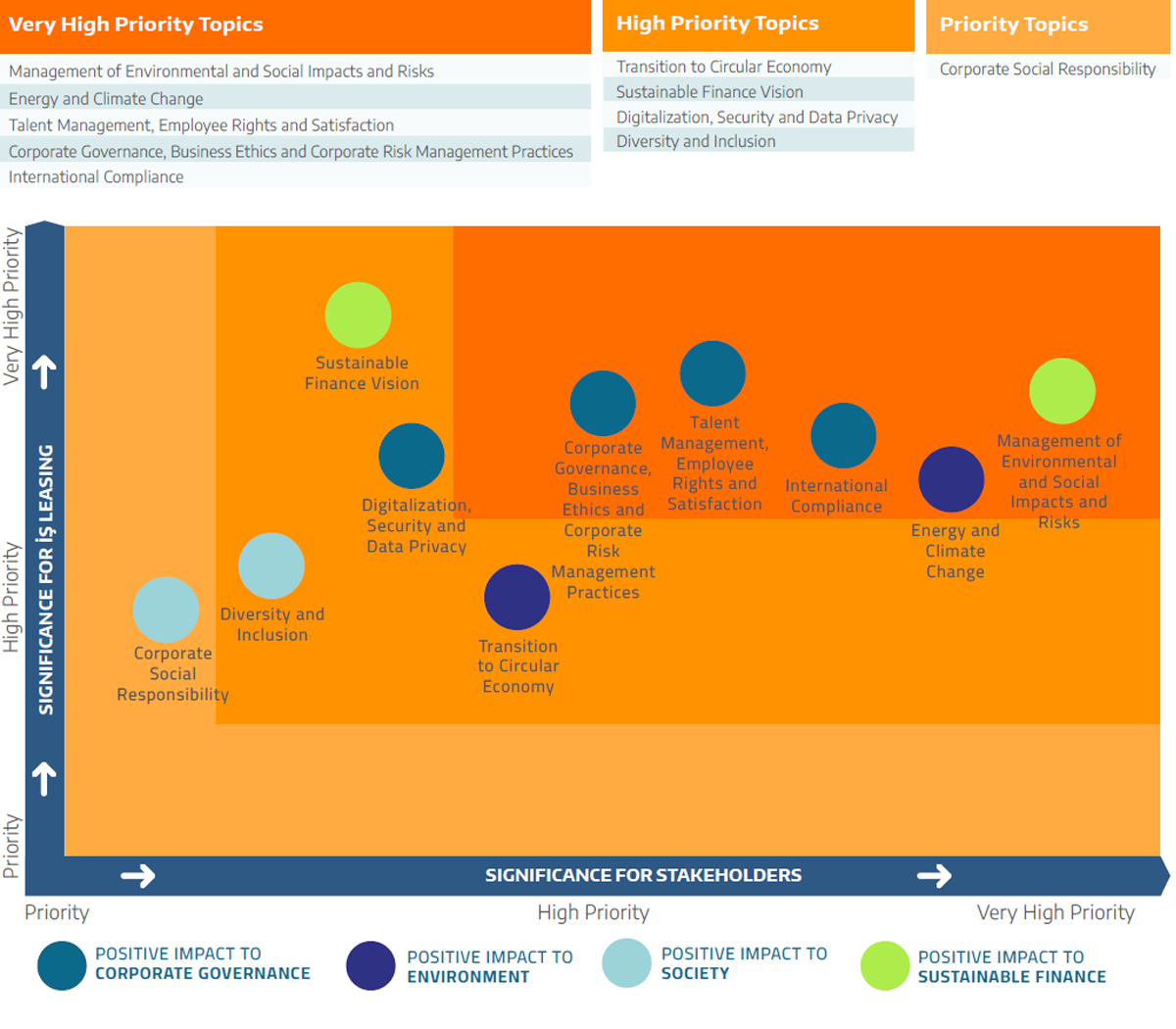

İş Leasing determines its sustainability priorities in accordance with internationally accepted analytical methods and the principle of stakeholder interaction. In the process of determining sustainability topics, leading sustainability institutions in the sector, World Economic Forum (WEF) Global Risks Report, United Nations Responsible Investment Principles (UN-PRI), EU Green Deal and sectoral researches were examined. Sustainability topics identified as a result of current literature and sources review were presented to internal and external stakeholders’ evaluation with an online survey method. In the survey, the identified topics were weighted by the stakeholders according to their priority levels, and a priority matrix was created through feedback received from the stakeholders.

The priority matrix is divided into three classes as priority, high priority, and very high priority. The very high priority topics and high priority topics identified according to this classification are as follows:

Management of environmental and social impacts and risks arising from operations and leasing activities

Managing the effects of activities such as greenhouse gas emissions, climate-related risks, energy consumption on nature; contributions made by leasing activities on renewable energy, energy efficiency and combating and adapting to climate change

Training, career management, improvement of working conditions, etc. carried out to reach and maintain a hightalent employee profile

Corporate governance principles, anti-bribery and anticorruption efforts, regulatory compliance, integrated risk management practices

Compliance with globally responsible investment standards, which have a transformative role in the transition to a green economy, International Sustainability Standards Board (ISSB)

Practices to reduce waste production and waste levels, ensure sustainable management and effective use of natural resources, support reduction of water stress, increase water utilization efficiency

Sustainable finance practices for shareholders, investors, creditors

Developing digital channels, expanding and facilitating customer transaction capability through digital channels, practices of security and data privacy

Studies that will support access to financial services by all segments of society, promote equal conditions, and the empowerment of women and vulnerable groups

Direct support and sponsorships for education, culture and arts, sports, social aid, volunteering, etc. and specific corporate social responsibility projects

Determining its sustainability priorities with active stakeholder engagement in light of priority matrix, İş Leasing built its sustainability strategy around the core areas of energy and resource efficiency, circularity, support for the transition to a low-carbon economy, environmental and social risk management, support for employment, corporate integrity and green transformation.

The strategic axes of Sustainable Finance are listed below:

Global financial institutions play a p olicy-making and leading role in solving ec onomic, environmental and social problems. İş Leasing is determined to support the 2030 Agenda announced by the United Nations and all s trategic local targets. Adopting and supporting the Sustainable Development Goals (SDGs), İş Leasing associated the priority topics and main axes of its sustainability strategy with SDGs. By expanding its strategic horizon and realigning its goals regarding SDGs in 2021, İş Leasing contributes directly or indirectly to 14 goals t hrough its activities within the scope of its sustainability strategy.

|

İş Leasing Sustainability Priorities |

İş Leasing Sustainability Clusters |

İş Leasing Sustainability Strategy Elements |

Relevant Sustainable Development Goals (SDG) (2030 Agenda) |

Relevant SDG Targets |

|

Management of Environmental and Social Impacts and Risks |

Positive Impact to Sustainable Finance |

» Assessment of Environmental and Social Risks in Investment Projects » Financing of Transition to Circular Economy |

|

3.9 - 5.1 - 5.5 - 6.3 - 6.6 7.2 - 8.7 - 9.1 - 9.4 - 12.4 13.3 - 14.1 - 14.2 - 15.7 |

|

Energy and Climate Change |

Positive Impact to Environment |

» Financing Renewable Energy Projects » Support for Transition to a Low-Carbon Economy to Combat Climate Change |

|

7.2 - 7.3 - 9.4 - 13.1 - 13.2 |

|

Talent Management, Employee Rights and Satisfaction |

Positive Impact to Corporate Governance |

» Sustainability Oriented Corporate Integrity, Transformation and Capacity Building |

|

4.4 - 4.5 - 5.5 - 8.5 - 8.8 10.4 |

|

Corporate Governance, Business Ethics and Corporate Risk Management Practices |

Positive Impact to Corporate Governance |

» Sustainability Oriented Corporate Integrity, Transformation and Capacity Building |

|

8.2 |

|

International Compliance |

Positive Impact to Corporate Governance |

» Sustainability Oriented Corporate Integrity, Transformation and Capacity Building |

|

13.3 - 16.6 - 16.8 |

|

Transition to Circular Economy |

Positive Impact to Environment |

» Assessment of Environmental and Social Risks in Investment Projects » Financing of Transition to Circular Economy |

|

6.3 - 6.4 - 9.4 - 12.4 - 12.5 |

|

Sustainable Finance Vision |

Positive Impact of Sustainable Finance |

» Financing of Projects to Support Economic Growth and Domestic Employment with Green Development Principles |

|

8.2 - 8.3 - 8.4 - 8.10 - 9.1 9.2 - 9.3 - 9.4 |

|

Digitization, Security and Information Privacy |

Positive Impact to Corporate Governance |

» Sustainability Focused Corporate Integrity, Transformation and Capacity Building |

|

9.1 - 12.5 |

|

Diversity and Inclusion |

Positive Impact to Society |

» Financing of Projects to Support Economic Growth and Domestic Employment with Green Development

Principles |

|

5.1 - 10.2 - 10.5 - 17.3 - 17.5 |

|

Corporate Social Responsibility |

Positive Impact to Society |

» Sustainability Oriented Corporate Integrity, Transformation and Capacity Building |

|

4.4 - 4.6 - 4.b - 5.1 - 9.5 10.3 - 17.6 - 17.16 - 17.17 |