İş Leasing was incorporated in 1988 as one of the first leasing companies in Türkiye as a result of Türkiye İş Bank Group’s partnership with Societe Generale and IFC, a World Bank institution. In 1995, Türkiye İş Bankası acquired all the shares held by foreign partners and reinvigorated Company’s activities. İş Leasing quickly became one of the leading companies in the leasing sector, thanks to the leverage of extensive nationwide branch network and institutional vision of Türkiye İş Bankası. İş Leasing is a public company since 2000 and 41.8% of its shares are traded on Borsa Istanbul (BIST). İş Leasing shares are listed in BIST All, BIST 10-30, BIST 50, BIST 100, BIST Corporate Governance, BIST Financial, BIST Star and BIST Leasing, Factoring indexes.

İş Leasing increased its business volume steadily by continuous improvement since its establishment, and became one of the leading companies in the sector by combining its experience in the leasing sector with corporate governance activities.

İş Leasing stood out in competition and made a difference in several areas particularly in customer experience by renewed ways of doing business and rapid decision-making mechanisms.

Having accomplished the first lease syndication in Türkiye through its product development and solution-oriented approach, İş Leasing also paved the way for the leasing sector by executing the first aircraft financing, and the first sale and leaseback transactions.

With its strong and stable financial structure, İş Leasing finances many projects, especially renewable energy and efficiency projects, that support domestic employment and sustainable development. It is also the preferred lessor in the leasing sector thanks to its customer-oriented service approach.

İş Leasing corporate culture embraced the vision of Green Transformation, Decarbonization and Sustainable Development, all of which will act as competitive advantages in the future in both the real and financial sectors. Consequently, it solidified its leading position with its sustainable finance approach.

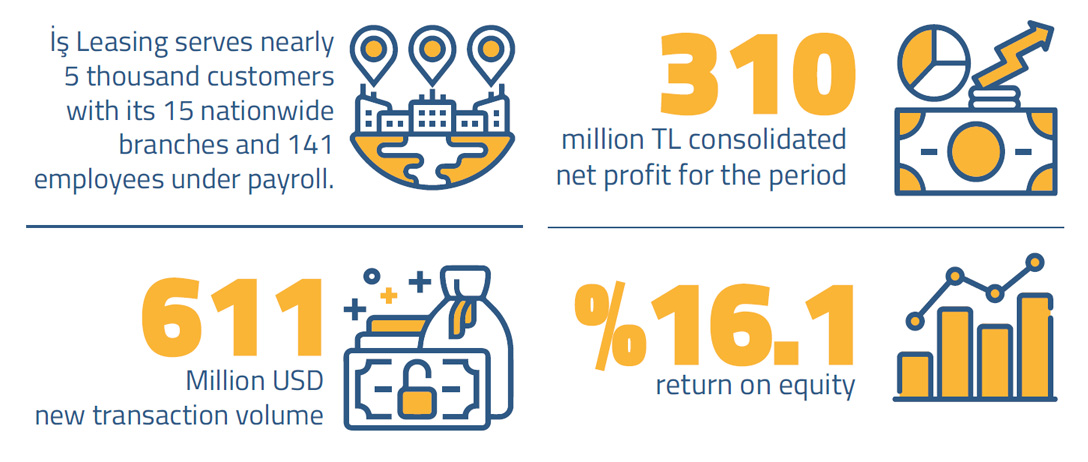

İş Leasing serves nearly 5 thousand customers with its 15 nationwide branches and 141 employees under payroll.

As a leading service provider in the sector with competent human resources, know-how, effective service model and solid financial structure, İş Leasing achieves a stable and healthy performance through its sustainable and profitable growth strategy.

Meeting its economic performance targets through dynamic balance sheet management in 2021, İş Leasing captured an extra market share of 16.5% with additional transaction volume of USD 611 million. With this performance, the Company maintained its position in the sector in terms of leasing receivables.

Boosting renewable energy investments with a focus on sustainability and decarbonization, İş Leasing provided a total of USD 55.1 million funding to renewable energy projects in 2020 and 2021.

Thanks to application of modern methodologies and techniques in credit risk, effective risk management processes and wide-ranging quality portfolio structure, the Company’s non-performing loans (NPL) ratio remained significantly below sector average. Despite post-pandemic conditions, global economic turbulence, inflationary pressures and high depreciation of the Turkish Lira, the NPL ratio, stood at 4.9% at the end of 2021 thanks to effective risk management.

|

Our Branches |

|

|

|---|---|---|

|

İstanbul-Kozyatağı |

Ankara-Capital |

İzmir-Aegean |

|

İstanbul-Gebze |

Ankara-Ostim |

Kayseri |

|

İstanbul-Şişli |

Antalya-Mediterranean |

Konya |

|

İstanbul-Avcılar |

Adana-Çukurova |

Trabzon |

|

Bursa-Marmara |

Gaziantep-Southern Anatolia |

Diyarbakır |