As key financial institutions in the global economic system, we have encountered the challenges of a turbulent and uncertain period of transition over the past two years that started with the pandemic.

Year 2021 will be inscribed in the history of economics as a special year in which global post-pandemic dynamics were sorted out and the global regulations for sustainable finance were looming in order to accelerate the transition in economic recovery. In addition, the vision of combating the climate crisis and decarbonization, which became a priority for the financial world within sustainability perspective, is regarded crucial with its transformational power.

The European Commission, which plans to reduce emissions by at least 55% by 2030 with a Green Deal vision, aims to transform Europe into the world’s first climate-neutral continent by 2050. In the meanwhile, it accelerated its work to create a criterion (taxonomy) for a common language and assessment that will define sustainability and environmental benefit generation capability of economic activities. The Commission has also adopted a comprehensive sustainable finance package that will help increase sustainabilityoriented business models across European Union. The regulatory systems that are being developed will also significantly affect all countries that have trade relations with the European Union countries. It is observed that sustainable finance and taxonomy studies are also carried out by eastern countries such as China and Japan. Financial regulators of these countries are trying to establish financial standards within the scope of sustainability taxonomy in order to direct the funding provided by international organizations to sustainable activities.

Decarbonisation-oriented sustainability approach created with Green Deal vision, created a domino effect in global markets and led to the adoption of a new international trade balance, which is also closely relevant to our country. It is clear that the essence of the transformation of global markets is to enable future generations to live in a better and cleaner world. Limiting the global temperature increases in the Paris Climate Agreement to 1.5 degrees, and creating a new and sustainable economic growth model, known as Green Development, has become the common goal of all humanity.

With the financial focus shifting towards activities supporting decarbonization vision and sustainability approaches, we as İş Leasing, decided to accelerate our efforts to meet the future in line with the principles of sustainable finance together with our stakeholders.

Our country became a party to the Paris Climate Agreement in 2021 and defined its commitment to fight the climate crisis with the 2053 net-zero emissions target. After the enforcement of Paris Climate Agreement, the groundwork is progressing for the Climate Law, which will form the legal infrastructure of the national targets to combat climate change. However, proper consideration of environmental, social and governance (ESG) related metrics in global investment strategies by finance sector is of great essence. In order to benefit from international green finance markets, studies are carried out by relevant institutions and organizations for the development of sustainable finance instruments and green bond market.

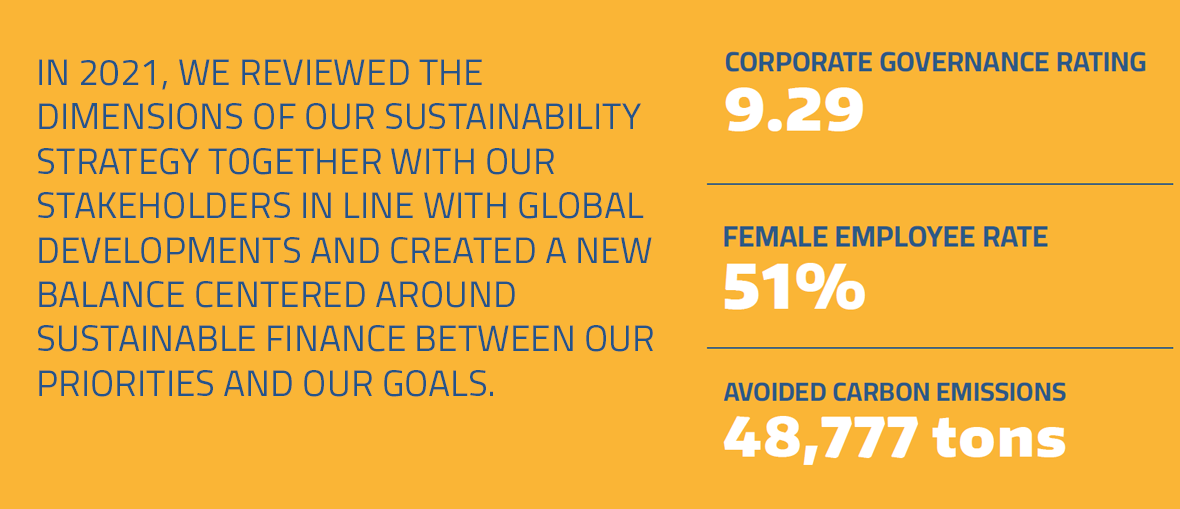

In 2021, we reviewed the dimensions of our sustainability strategy together with our stakeholders in line with global developments and created a new balance centered around sustainable finance between our priorities and our goals.

We have completed our corporate greenhouse gas inventory calculations arising from our operations in accordance with international protocols, which will enable combat against climate crisis. We aim to be the first carbon neutral leasing company by 2024 in our sector, by eliminating our carbon footprint resulting from our operations.

At the center of our responsible investment principles, which we embraced in our management culture since our inception, is to manage our financing activities correctly and to have a positive impact on our world in the future. Aware of this responsibility and taking the first steps in the leasing sector, we accelerated our advanced carbon management and net zero emission transactions in 2021 in order to prepare our effective emission reduction plans in our entire value chain through 2040 and 2050 utilizing the methods of Science- Based Targets Initiative (SBTi).

We consider the most important infrastructure component in the green development process is the increased usage rate of renewable energy by providing access to sustainable, clean and modern energy. The building blocks of our sustainable finance practices are expansion and prevalence of renewable energy through energy efficiency, energy independence in the sectors we are funding, and acceleration of the transition to circular economy. The green investment model we adopt contributes to reduction of risks in operating expenses in the face of increasing trend in energy prices in all sectors.

In 2021, we provided 40 million USD additional funding within the scope of renewable energy investments, enabling the cumulative installed capacity of our projects to reach 202 MW. Out of the renewable energy projects we funded, 124 MW was Solar Power Plant (SPP), 63 MW was Wind Power Plant (WPP) and 1 MW was Biomass Power Plant (BPP). Apart from these, we funded a cogeneration project with a total installed capacity of 14 MW.

Within the scope of the TurSEFF (Türkiye Sustainable Energy Financing Facility), in which we are a partner, we have achieved an important success story by funding a total of 40 million Euros to 305 projects, primarily green projects from the agricultural sector, in just one year. With the projects we funded under TurSEFF, we contributed to the 12.3 MW installed power and avoided 48,777 tons of carbon emissions as a result of gains in efficiency and savings.

Our constantly updated sustainable growth strategy and dynamic balance sheet management processes along with our strong financial structure, enabled us to return stable profits and to maintain our new transactions market share in 2021. Thus, we consolidated our second position in the sector in terms of leasing receivables.

We embrace accountability, equality, transparency and responsibility as part of our corporate culture in all interactions with our stakeholders. We are determined to carry these values, which we identify with our business models, to even higher levels in the future. We are expanding our ethical approach, which is a necessity for robust corporate governance, and our corporate culture shaped by business ethics, into our entire value chain, primarily our employees.

As a result of our continuous improvement activities and our strong will, İş Leasing’s corporate governance rating rose to 9.29 out of 10 (92.91%). In addition, we conduct our management model and all our processes in utmost compliance with the Corporate Governance Principles and Sustainability Principles Framework of the Capital Markets Board (CMB).

Together with our employees, we support egalitarian and transparent policies that respect human rights throughout our entire value chain. Offering an inclusive and professional working environment with fair and equal opportunities to our employees, our biggest asset, is at the center of our human resources policies.

In addition to ensuring compliance with international norms and legal regulations to improve the rights of our employees, we develop human resources policies in line with the principles of the United Nations Global Compact, which we aim to become a signatory member in 2022.

In 2021, we included 94% of our employees in the regular performance evaluation process. In the coming period, we aim to improve our employees’ competencies with brand new job descriptions, to be the most preferred company in the leasing sector, and to develop practices that prioritize employee satisfaction and job satisfaction.

Our training and talent development activities are decisive in achieving success, and in 2021, we focused on trainings in advanced carbon management, combating climate change and sustainability.

We constantly support new ideas and suggestions through the mechanisms we have developed to ensure active employee participation in decision-making processes in a systematic way.

While our female employment ratio was 51% and our female executive ratio was 38% in 2021, we have embraced female employee support as an uncompromising principle since our inception. By signing the United Nations Women’s Empowerment Principles (UN WEPs) in 2022, we will publicize our goal of becoming an egalitarian and inclusive company in the leasing sector.

Sustainability philosophy shapes the visionary pivot of new management approaches, and we as İş Leasing, march firmly on the right path to ensure a fair transition to sustainable financial system aligned with green development.

In order to enable a future in which we live in peace, prosperity and security, our responsibility increases every day to make a positive impact on social life and our world.

Considering the achievements of all our stakeholders, we will continue to carry out our sustainable finance activities and accept responsibility by creating a positive impact on our sector, our value chain and all segments of society.

With our second published sustainability report, we present to you, our stakeholders, the progress we have made in all dimensions of sustainability.

We would like to thank our Board of Directors, our employees, all our business par tners and all our stakeholders, who contributed to the realization of aforementioned performance, the details of which we have presented in our report.

Best regards,

N. BURAK SEYREK

Chairman

U. ŞAFAK ÖĞÜN

General Manager

and Board Member