The negative effects of climate change have hit the level of a global crisis, regardless of country, region, sector or economic market, and are constantly expanding to a risk level that can destroy the global economy. İş Leasing is aware that the reality of climate change has turned into an existential problem with negative effects on all lifestyles and needs urgent solution. Being aware of the fact that its activities and services have an impact on climate change, İş Leasing prepares its decarbonization plans with the aim of managing this impact accurately and creating a positive ecological impact on our world for the future.

Our country became a party to the Paris Agreement in 2021 and marked its determination to fight the climate crisis with the 2053 net-zero emission target. With the enforcement of the Paris Agreement, the preparations for the Climate Law, which will improve the national targets on combating climate change on a legal basis, are in motion.

|

Funding of Renewable Energy |

2013-2017 |

2018 |

2019 |

2020 |

2021 |

|---|---|---|---|---|---|

|

Amount of funding provided to renewable energy projects (USD) |

66.783.815 |

2.200.000 |

8.080.665 |

39.286.734 |

39.837.353 |

|

Installed power capacity of funded renewable energy projects (in year - new) (MW) |

80,40 |

2,30 |

13,60 |

49,48 |

70,67 |

|

Total installed power capacity of funded renewable energy projects - consolidated (MW) |

80,40 |

82,7 |

96,3 |

145,78 |

216,45 |

İş Leasing aspires to become a carbon neutral financial institution by 2024 by eliminating the carbon footprint of its operations after completing its corporate greenhouse gas inventory calculations in 2021 in line with international regulations.The company plans to take the first steps in advanced carbon management and net zero emission studies to prepare emission reduction approaches extending to 2040 and 2050 with the methods determined by the Science-Based Targets Initiative (SBTi) in a way that will be effective across the entire value chain.

Reducing greenhouse gas emissions is a c orporate principle that supports ethical investing practices that increase awareness across the whole value chain and promote climate change action. İş Leasing actively supports initiatives that facilitate the transition to a low-carbon economy and green transformation methods by creating solutions to the climate change in order to leave a more habitable planet for future generations.

Increasing the rate of use of renewable energy by providing access to sustainable, clean and modern energy is the most effective tool of green development theory that enables sustainability transformation in sectors. Providing funding for renewable energy investments is among İş Leasing’s strategic priorities.

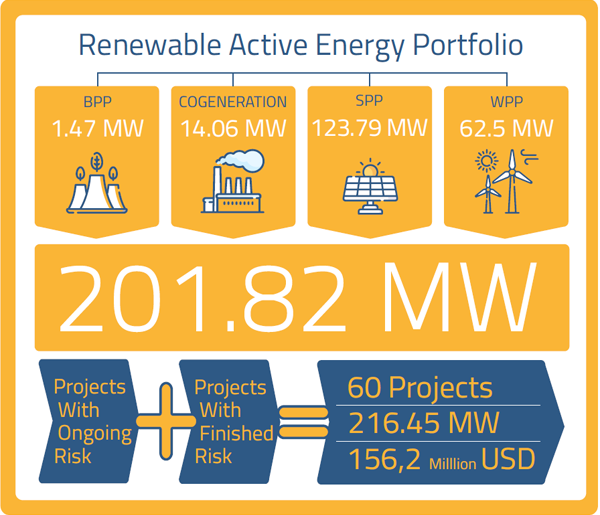

İş Leasing provided USD 40 million in funding to renewable energy projects in 2021. The total installed power capacity of the renewable energy projects that İş Leasing funded reached 216.45 MW in 2021. This funding approach stands out particularly in the solar energy sector.

Approximately 124 MW Solar Power Plant (GES), 63 MW Wind Power Plant (RES) and 1 MW Biomass P ower Plant (BES) are among the renewable energy projects financed. Apart from these, İş Leasing financed a cogeneration project with a total installed capacity of 14 MW.

İş Leasing had 60 active projects financed by the end of 2021. In addition, there are 14 projects to receive funding allocation worth US$ 25.5 million with a capacity of 33.21 MW in the upcoming period. It has put into action a total of 60 projects with a combined capacity of 216.45 MW, and up until the end of 2021, it has funded USD 156.2 million to these projects including projects with ongoing risk and projects with no risks left.

The COVID-19 pandemic process has emphasized the need for increased global efforts on sustainability practices by all stakeholders at all levels. Building a sustainable and inclusive global economy has moved up in the international community’s list of priorities during the post-pandemic recovery era. The largest environmental and social risk area is the failure of the action plans created to tackle climate change, according to the World Economic Forum’s Global Risks 2021 Report. The risks expressed in the report are at a level that could cause global destruction.

The green development vision defines sustainabilityrelated elements as an integral part of the financial sector. Sustainable finance practices aim to evaluate environmental, social and governance issues (ESG) while making investment decisions and to direct finance to sustainable economic activities and projects.

Within the scope of the global financial market, a distinctive classification system (taxonomy) is being developed with global sustainability standards, which creates a list of environmentally sustainable economic activities in order to direct investments to sustainable projects and activities and helps companies determine which of their economic activities are environmentally sustainable.

İş Leasing has accelerated its efforts to comply with global sustainability standards, which are being developed by taking into account all risks that may have an impact on the global financial system. The company aims to reduce ESG risks defined by global standards and regulations with appropriate governance and assessment approaches.

In our country, issues such as the preparation of national green taxonomy legislation and national green finance strategy, and the creation of infrastructure for the definition, measurement and management of climate-related financial risks have been prioritized by policy-making institutions.

İş Leasing aims to benefit more from national and international green finance markets by closely monitoring the studies on the development of sustainable finance instruments and the green bond market in our country.

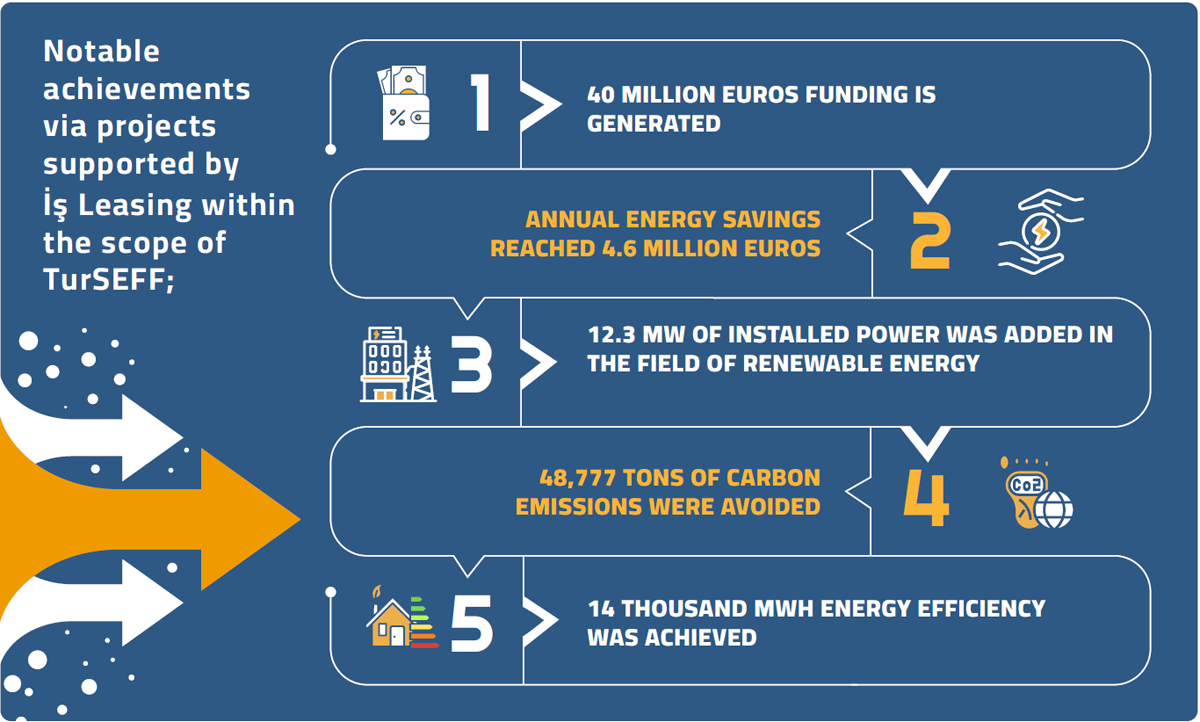

The Turkish Sustainable Energy Financing Facility, or TurSEFF, is a financing initative which was designed with the notion of sustainability at its heart. TurSEFF, the Turkish implementation of the SEFF/GEFF initiative carried out by the EBRD (European Bank for Reconstruction and Development) in 26 countries around the world, provides financing and technical support to green investments of SMEs, large companies, municipalities and public institutions. These green investments cover all components of sustainability in a wide range from electric motor replacement of SMEs to roof and land type solar energy investments, from sustainable energy projects made by large enterprises through ESCO to public transportation, drinking water, waste water and energy investments of municipalities.