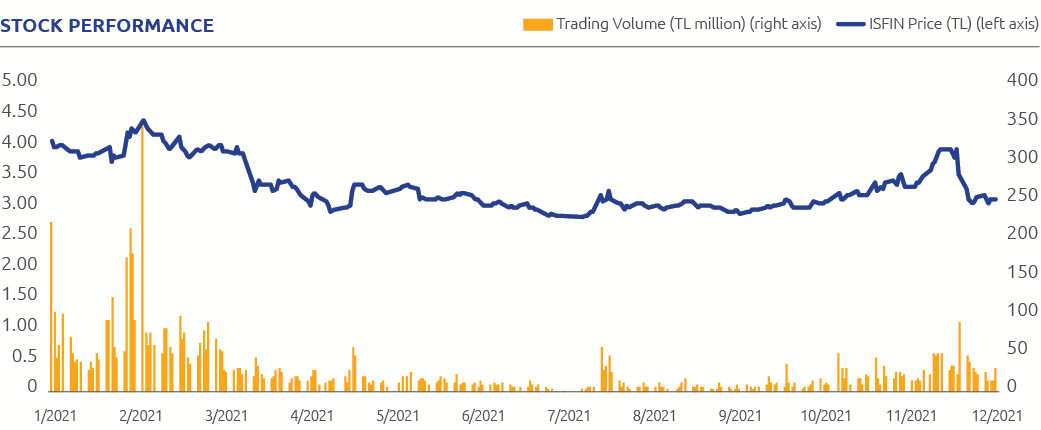

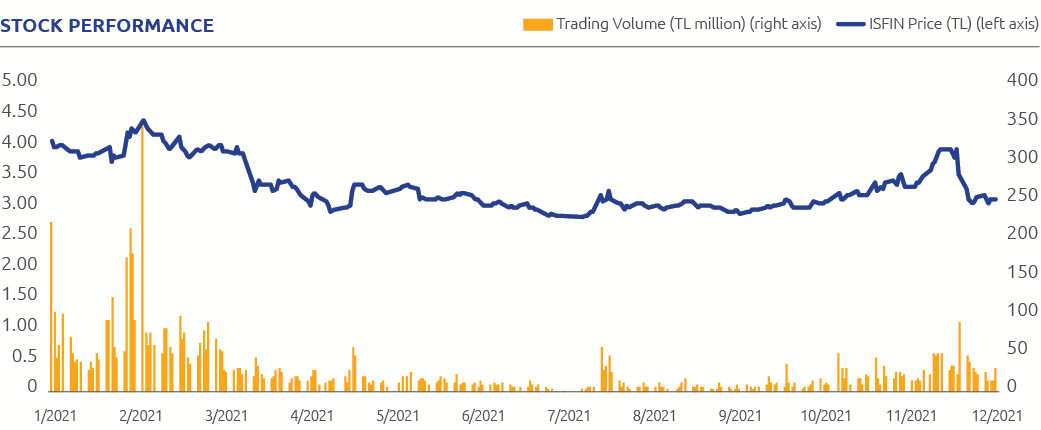

Stock Performance

Having gone up by 29.1% in 2020, the BIST 100 index also increased by 25.8% in 2021. Hence, including the 25.4% rise of 2019, the index has achieved growth for three consecutive years for the first time in the past 15 years. The index closed the year 2021 at 1,857.65.

İş Leasing, which is a Group B share, is traded on the Stars Market. Also a constituent of the BIST Corporate Governance Index by virtue of its effective corporate governance practices, the Company is also included in the BIST Financial and BIST Leasing Factoring indices. Publicly-held since 2000 and 41.8% of its shares traded on BIST, İş Leasing had a daily average trading volume of TL 29.4 billion in 2021 and closed the year with a stock price of TL 3.10.

Corporate Governance

İş Leasing, a believer in the necessity of an effective corporate governance system to successfully attain its goals through sustainable performance, continually furthers its practices, maintaining a communication with its stakeholders built on the principles of accuracy, transparency, fairness, trust and accountability, and targeting best corporate governance models.

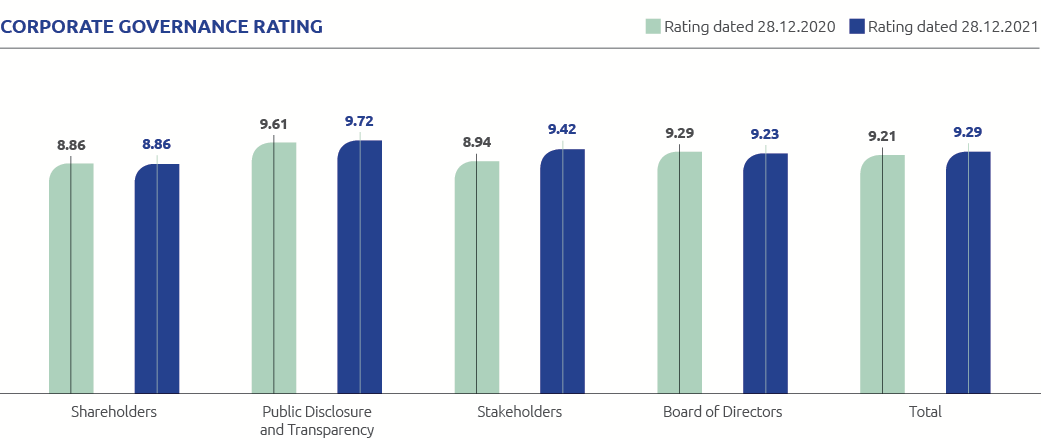

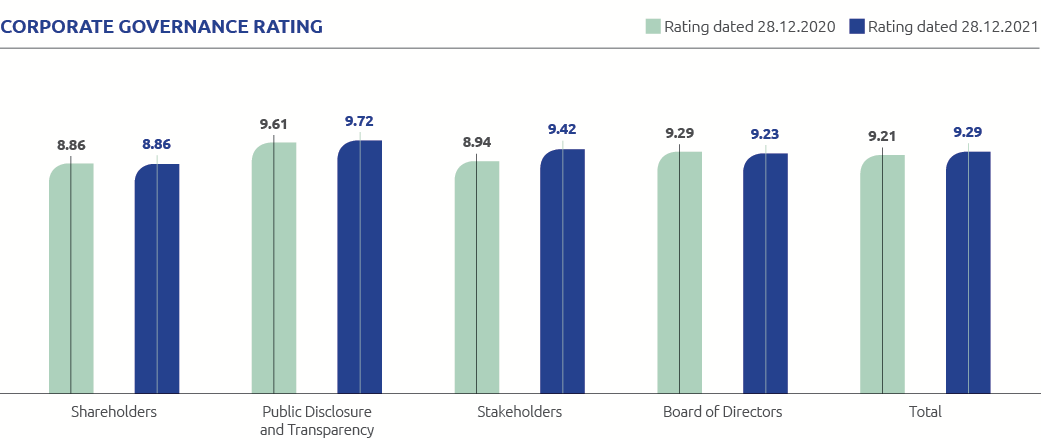

Corporate Governance Rating

In 2021, İş Leasing was assigned a corporate governance rating of 9.29 (92.91%) on a scale of 10 by Saha Kurumsal Yönetim ve Kredi Derecelendirme Hizmetleri A.Ş.

Credit Rating

In its rating report dated 10 December 2021, Fitch Ratings announced the local and international currency ratings of İş Leasing as A+(tur) and B+, respectively.

Foreign Currency |

|

Long Term |

B+ |

Short Term |

B |

Outlook |

Negative |

|

|

Turkish Lira |

|

Long Term |

B+ |

Short Term |

B |

Outlook |

Negative |

|

|

National |

|

Long Term |

A+(tur) |

Outlook |

Stable |

Support Rating |

4 |