Regarding sustainability an integral part of its way of doing business, İş Leasing remains the choice of a large customer segment.

Incorporated in 1988 as a partnership of Türkiye İş Bankası (İşbank) Group with IFC, a member of the World Bank Group, and Société Generale, İş Leasing is one of the first leasing companies in Turkey. In 1995, İşbank acquired all of the shares held by foreign shareholders. Thanks to the synergy created with İşbank Group and primarily İşbank’s branch network extending all over the country, İş Leasing quickly became one of the leading companies in the sector.

Part of the Company’s shares was offered to the public in 2000, thus making İş Leasing one of the first leasing companies to go public.

The Company steered the sector and contributed significantly to its growth through numerous “first”s including the first lease syndication, the first aircraft lease facility, and the first sale-and-leaseback transactions, and the first debt instrument issue based on its new product development and solution creation capabilities.

While İş Leasing leads the financing of projects that contribute to the national economy with its solid funding means, the Company particularly sustains its support uninterruptedly to sectors creating employment and added value.

Regarding sustainability an integral part of its way of doing business, İş Leasing remains the choice of a broad customer segment wishing to capitalize on their investment projects quickly, accurately and efficiently because of its high quality and solution-oriented service concept.

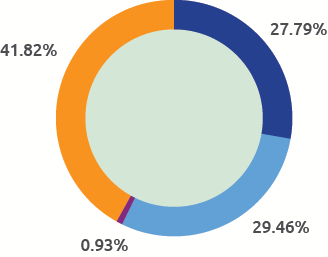

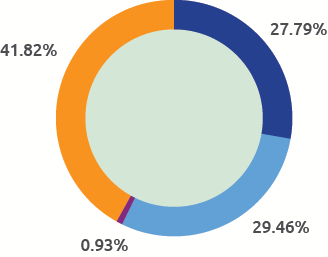

41.8% of İş Leasing’s shares are being traded on Borsa İstanbul under the ticker symbol “ISFIN”, while the remaining 58.2% is held by İşbank Group, along with full management control over the Company.

Shareholding Structure (%)

Shareholder |

Share Amount (TL) |

Capital Share (%) |

Türkiye İş Bankası A.Ş. |

193,253,262.93 |

27.79 |

Türkiye Sınai Kalkınma Bankası A.Ş. |

204,850,378.33 |

29.46 |

Trakya Yatırım Holding A.Ş. |

6,482,770.65 |

0.93 |

Publicly held |

290,716,233.09 |

41.82 |

Total |

695,302,645.00 |

100.0 |