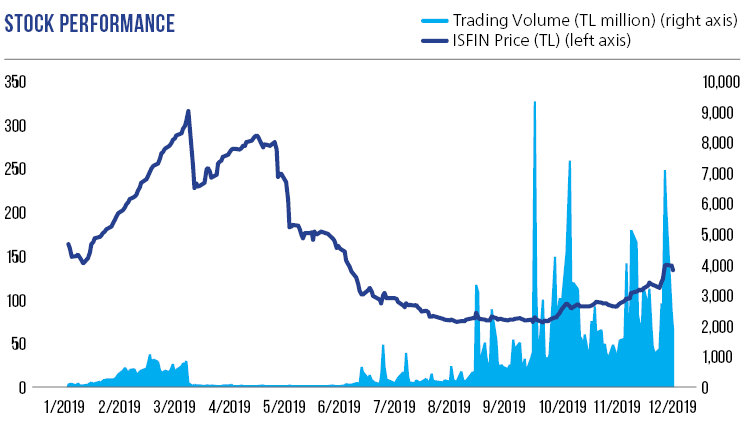

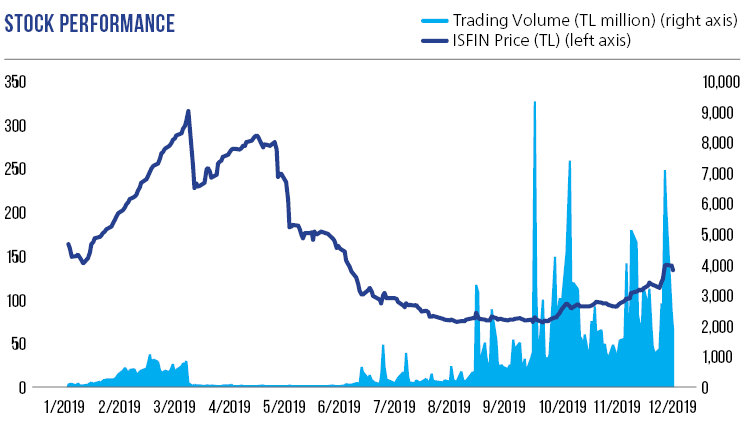

STOCK PERFORMANCE

While 2019 was tainted by the trade wars between the US and China, Brexit, and geopolitical uncertainties affecting the geography that also covers Turkey, BIST 100 index was up by 25.4 percent in 2019 with the added support of the global markets that presented buyers towards the end of the year, and closed the year at 114,425.

Publicly-held since 2000 and 41,8% of its shares traded on BIST, İş Leasing remained the sector’s most important benchmark stock with an average trading volume of 29,190,321 transactions in 2019.

CORPORATE GOVERNANCE

İş Leasing, a believer in the necessity of an effective corporate governance system to successfully attain its goals through sustainable performance, continually furthers its practices, maintaining a communication with its stakeholders built on the principles of accuracy, transparency, fairness, trust and accountability, and targeting best corporate governance models.

A+(TUR)

IN ITS RATING REPORT DATED 12 NOVEMBER 2019, FITCH RATINGS ANNOUNCED THE LOCAL AND INTERNATIONAL CURRENCY RATINGS OF İŞ LEASING AS A+(TUR) AND B, RESPECTIVELY.

CREDIT RATING

In its rating report dated 12 November 2019, Fitch Ratings announced the local and international currency ratings of İş Leasing as A+(tur) and B+, respectively.

Foreign Currency |

Long Term |

Short Term |

Outlook |

B |

B |

Negative |

Turkish Lira |

Long Term |

Short Term |

Outlook |

B+ |

B |

Stable |

National |

Long Term |

Support Rating |

Outlook |

A+(tur) |

4 |

Stable |